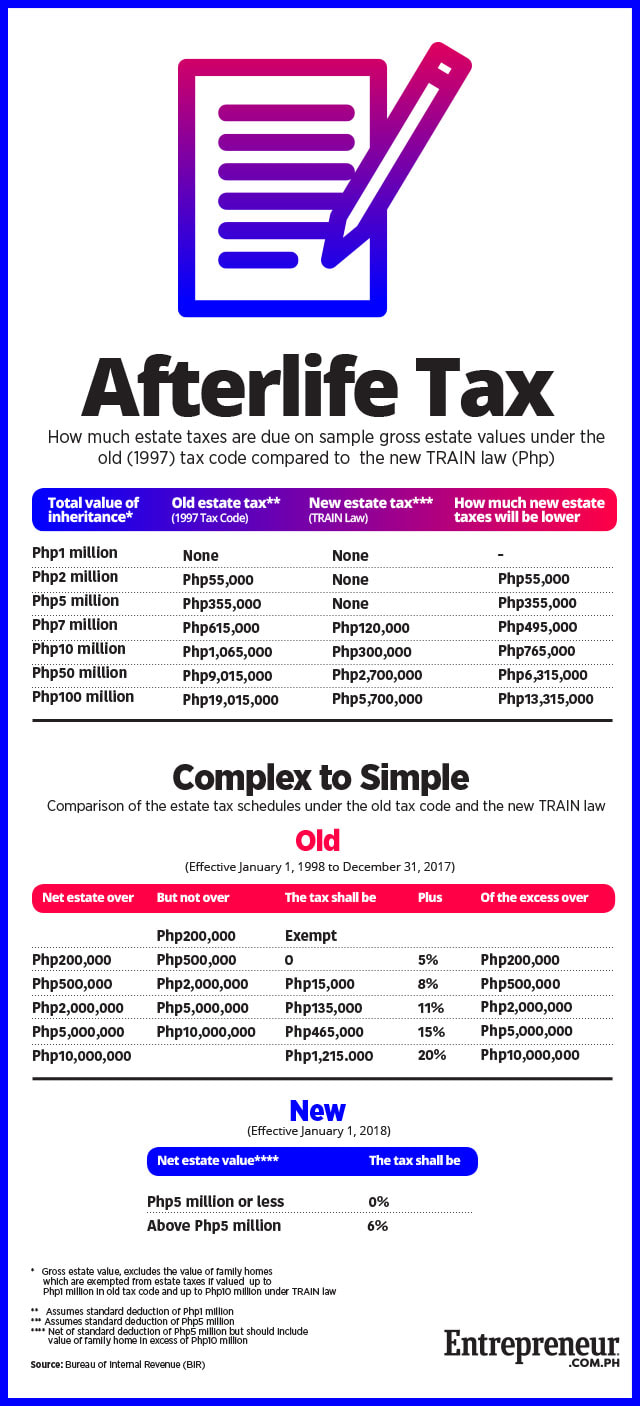

By Lorenzo Kyle SubidoThe new law cuts the tax on inherited assets and simplifies the process of computing it Among the many taxes revised by the Tax Reform for Acceleration and Inclusion or TRAIN law, which officially took effect at the start of 2018, is the estate tax. It’s the government’s cut on inheritance or the transfer of assets belonging to a deceased person to his or her heirs. Under the National Internal Revenue Code that took effect in 1997, estate tax rates varied depending on the net value of the deceased’s properties, which referred to the total value of the inherited assets less all the allowable deductions. The varying tax rate consisted of a fixed tax (ranging from Php15,000 to Php1.2 million) plus a percentage (ranging from five percent to 20 percent) applied to amounts above specified levels (ranging from Php200,000 to Php10 million) The allowable deductions include a standard deduction of Php1 million as well as extra deductions for funeral expenses, medical expenses made within one year before death and the value of the family homes up to Php1 million. The worth of family homes above Php1 million were added to the net value on which the tax rates are applied. Calculating the estate tax, which is rather complicated under the old tax code, was simplified under the TRAIN law. The new law just imposes a single, flat rate of six percent, applied to the net value of the inheritance. It also collapsed the various allowable deductions into a single standard deduction of Php5 million, which is higher than the previous amount. Similarly, the threshold value of the family home, above which will be added to the net estate, was increased to Php10 million from Php1 million. To see how the old and new tax rates will affect the amount of estate taxes due on a range of sample net estate values, see the infographic on this page.

It shows, for example that an inheritance with a value of Php10 million will be subject to estate taxes of Php300,000 under the TRAIN law, or just a third of the over Php1 million estate tax due under the old tax code. Beyond the lowering of estate taxes, the TRAIN law also gives more time to heirs to pay the tax before penalties are imposed. From six months after the deceased’s death under the old tax code, they now have up to a year to do so. Government planners hope the lower estate tax rates will improve compliance with the law. From 2006 to 2015, the Bureau of Internal Revenue noted that only between six and eight estate tax returns were filed out of every 100 deaths. The rest of the heirs didn’t bother filing and paying the estate taxes, which explains why many of the properties being bought and sold are still registered in the names of long deceased persons. Since estate taxes weren’t paid on most inheritance, the transferred assets, especially real estate, can’t be registered in the name of the new owners. Source: https://www.entrepreneur.com.ph/news-and-events/planning-ahead-want-to-know-how-much-estate-taxes-your-heirs-will-pay-under-train-law-a00200-20180119?ref=home_feed_2

1 Comment

|

Featured ArticleSupply of condo units tighteningThe Top 10 Reasons to Hire a Real Estate Agent8 Ways Real Estate Is Your Smartest InvestmentCategoriesArchives

May 2019

|

RSS Feed

RSS Feed