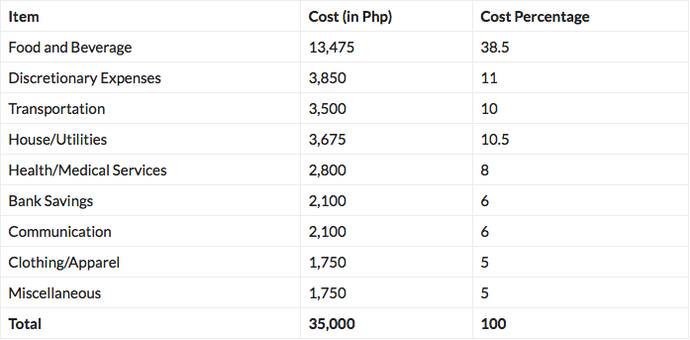

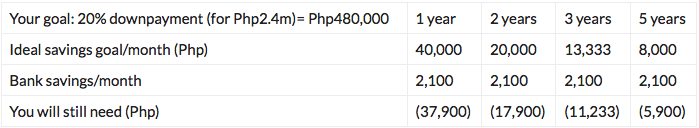

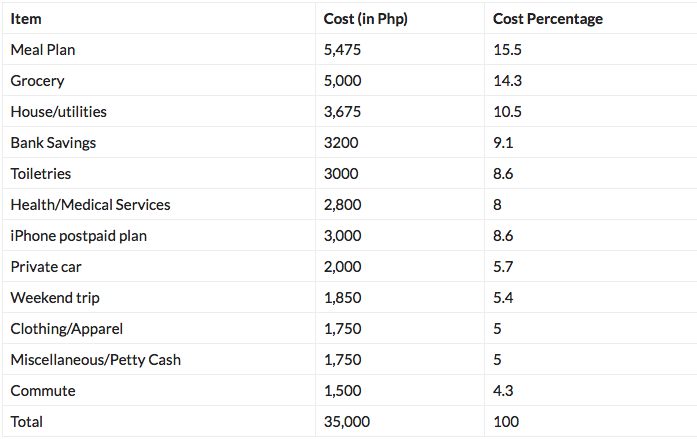

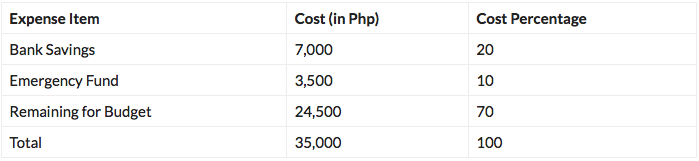

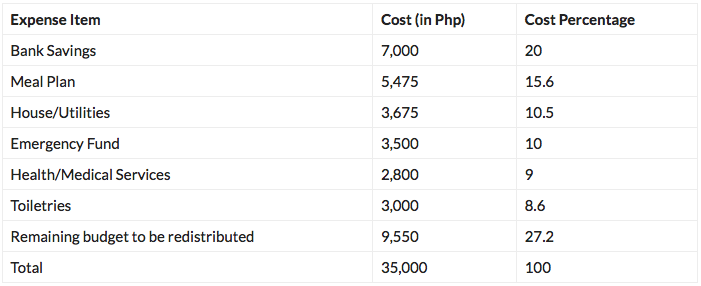

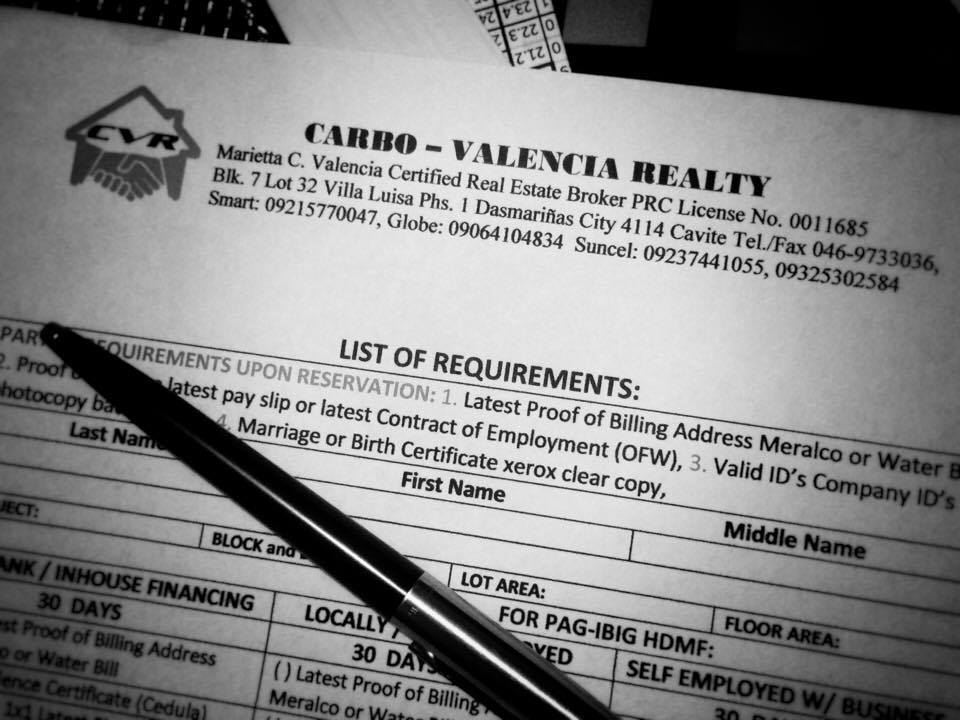

By Rizza Sta. AnaTrying to save money for a home? You can start by rethinking spending habits. Thinking about buying your own home in the near future? For some people who are living from paycheck to paycheck or accustomed to having certain luxuries, saving for your new home can involve a bit of sacrifice. Granted, there are bank financing options and attractive in-house financing programs offered by developers, which can help you make the first home-buying step. But you still need to have a significant amount of money to get started. After all, you still need to shell out money to cover certain expenses such as reservation fee, taxes, insurance, and other closing costs—all of which you will need to pay in cash. The ideal saving habit If you’re one of those people who cannot give up all of your small conveniences but are working on your home-buying goal, financial expert Randell Tiongson gives a solid piece of advice: “Create and stick to a budget!” So, how do you gradually save without losing sight of your end goal? Saving doesn’t mean cutting down on all of the things that make up your lifestyle. It is more efficient and realistic for you to aim for something, and then budget your money to accommodate your needs, and maybe allow some of the conveniences that you’ve grown accustomed to. To put things into perspective, how about an illustrative example? Let’s say the goal is to start putting up an earnest payment on an Avida condominium within the city on a monthly take-home pay of P35,000. The following would be an illustrative monthly household budget of a single working professional: In the Philippines, the ideal savings goal is 20 percent of your future home’s price. For properties selling at a million upwards, that can be a very daunting task, even for the above-average income earner. In the table below, we illustrate a savings plan over 1, 2, 3, and 5 years with the end goal of saving Php480,000, which would be the 20-percent downpayment for a Php2.4m condo unit for sale in Sucat, for example. For illustrative purposes, we put your monthly savings at Php2,100. As this amount isn’t the ideal savings goal, the amount left over in each period (bottom row) is what you will still need to save to come up with your ideal savings goal. To save the remaining amount, you will need to figure out which expenses you can do without, and which ones you can drop. This can be accomplished by categorizing your expenses into very specific criteria. In the table above, you can break down some of the items that are in the first table into specific categories. As for your data plan, you can switch to a cheaper plan at Php1,000, and shift the budget towards your monthly bank savings, bringing it to a total of Php3,200. Your iPhone postpaid plan budget remains unchanged, since we’ll consider this as a recurring investment. However, a Pesos and Sense article does have a more ideal way of allowing you to save for the minimum goal of Php5,900 (see second table, last column) using the following equation: Salary – (10% Emergency Fund) – (minimum 20% Save & Invest) = Budget Leftover So on a Php35,000 monthly salary, you can actually save Php7,000, or more based on the formula. Thus, your new workable household budget now would be as follows: You can budget your remaining Php24,500 leftover in two ways: 1. With Conveniences Since you already have money stashed for your bank savings and emergency fund, you can redistribute the budget to the newly categorized expenses that you set up earlier. List the expense items you consider fixed costs, and then redistribute the rest of the budget to discretionary items on your list. In our example, we will keep some of the items at the same budgeted expenses as in the first table, as they are deemed fixed and recurring expenses. As such: 2. Limited to no conveniences

Focused home seekers keep their eye on the prize, and will make major sacrifices in order to claim it. This would mean setting aside a budget for fixed, recurring expenses and doing away with discretionary expenses. In this case, clothing/apparel, private car service, and even that weekend trip will be off the table now. Budget for toiletries, grocery, and even transportation will be set at a minimum. Budget for miscellaneous expenses will be small to non-existent to add more to the savings pool. A little goes a long way However you choose to budget your salary, the main point of this exercise is to take a huge step toward building a fund to buy your future home. Even if it’s still short of the target savings goal, saving a significant amount (and having an emergency fund to boot), will give you enough runway to work on acquiring your condo unit or house and lot as compared to those who are heavily reliant on a home fund. Moreover, the reality is that money helps things move a little faster, from getting a broker to work with you to securing home financing simply because you offer less risk compared to other loan-reliant but cash-strapped homebuyers. Whether the goal is buying an affordable condo in Makati or Quezon City, reaching any specific amount requires more than just setting a numerical goal and establishing a savings timeline. It also requires you to take a careful look at your spending habits, and decide which expenses you can live without. When you’re finally ready to have a home of your own, find exactly what you’re looking for at our property market tab Source: http://pursuitofpassion.ph/practical-living/saving-for-a-home/

0 Comments

Leave a Reply. |

Featured ArticleSupply of condo units tighteningThe Top 10 Reasons to Hire a Real Estate Agent8 Ways Real Estate Is Your Smartest InvestmentCategoriesArchives

May 2019

|

RSS Feed

RSS Feed